More Than Just a Checking Account

There's plenty that comes with a Diamond Secure Checking Account, including a VISA Debit Card, free online and mobile banking, electronic statements and no minimum balance. Plus, pay family and friends with Zelle, use free online bill pay or transfer funds using TransferNow.

Identity Theft Monitoring and Resolution

Not only will IDProtect monitor over 1,000 databases and public records to track suspicious activity, but an IDProtect fraud resolution specialist will help you every step of the way should you become a victim of identity theft.

Get the Details

Extensive Cell Phone Protection

In the event your cell phone is stolen or damaged, you're eligible for up to $300 in reimbursement costs. Coverage requires a $50 deductible with a maximum of two claims per year.

Get the Details

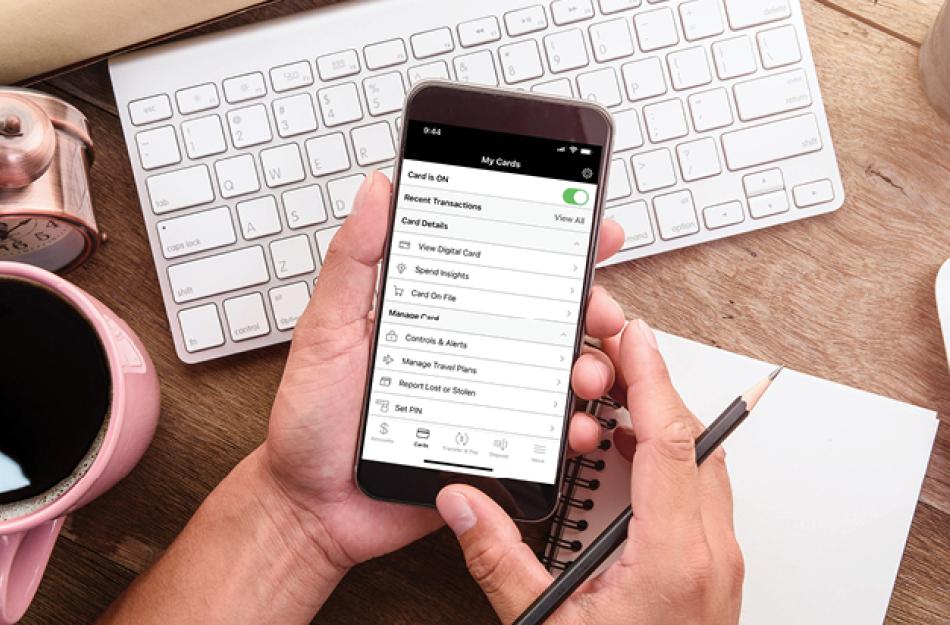

Safeguard Your Debit Cards

Use our mobile banking app to manage when and how your card(s) is used, set spending limits and alerts for all transactions, even turn your card(s) on and off as needed.

Get the Details

Customize Your Account Benefits

While there are plenty of benefits and services that come with an account, you might want to make some personal adjustments. For an additional $10 per month, you can customize the features within your account and receive more benefits too.

Get the DetailsFeatures of Diamond Secure

Service Charge

$4 service charge per statement cycle. No fee for electronic statements. Additional $5 paper statement fee per statement.

Minimum Balance

No minimum balance. $100 minimum balance to open.

Interest Rate

This account is non-interest bearing.

Benefits

IDProtect Identity Theft Protection Service. Cellular Telephone Protection.

Disclaimer: This account is only $4 per statement cycle. Special Program Notes: The descriptions herein are summaries only. They do not include all terms, conditions and exclusions of the Benefits described. Please refer to the actual Guide to Benefits for complete details of coverage and exclusions. Coverage is provided through the company and in the Guide to Benefits.

Benefits for Students

If you're currently in school, then we'd like to make life a little easier by offering several benefits to choose from when you open your account.

Benefits for Seniors

If you're a senior, then make the most of it financially by choosing from a number of benefits when you open your account.

Benefits for Military

We believe in doing a little more for account holders in the military, which is why there are several benefits to choose from when opening your account.

Start Your Application With Confidence

Thank you for considering Pinnacle Bank! The information below is designed to prepare you for a smooth and efficient application process, ensuring you have everything you need to complete your application quickly and effortlessly.

Complete Your Application In 5 Minutes

- Tell us about yourself

- Customize your account preferences

- Complete your initial deposit

What You'll Need To Apply

- Name, Address, Phone and Social Security Number or ITIN

- Valid ID (driver's license, state ID, passport)

- $100 minimum opening deposit from a card or bank account

Open In Minutes

Warning: External Link

You are leaving our website. The site you have chosen is independent from Pinnacle Bank/Bank of Colorado. We do not control external sites, and we cannot guarantee the accuracy, completeness, efficacy or timeliness of the information contained therein.

Warning: Email Link

We are happy to provide email communications with our customers, but please be advised that email is not a secure method of communication and should not be used to transmit sensitive information.